In September 2024, we at Unleashed by Purina investigated the soaring market growth and opportunities within the pet care space in Asia.

The main players, in terms of market size, were China, Thailand, South Korea and India.

And while a big part of the article was dedicated to India as a potential commercial giant, no one could predict the steep growth curve the market would undergo.

Not only are there more Indian pet parents than ever before, but there’s also far more demand for food, veterinary care and services than ever before.

If you’re prepared to play the long game, pet tech entrepreneurs and investors have a unique opportunity to get in early and benefit from this growth spurt.

So today, we’re diving deep into pet care innovation in India: the state of the market right now, the startups leading the way and the opportunities for growth yet to come.

The state of the pet care industry in India

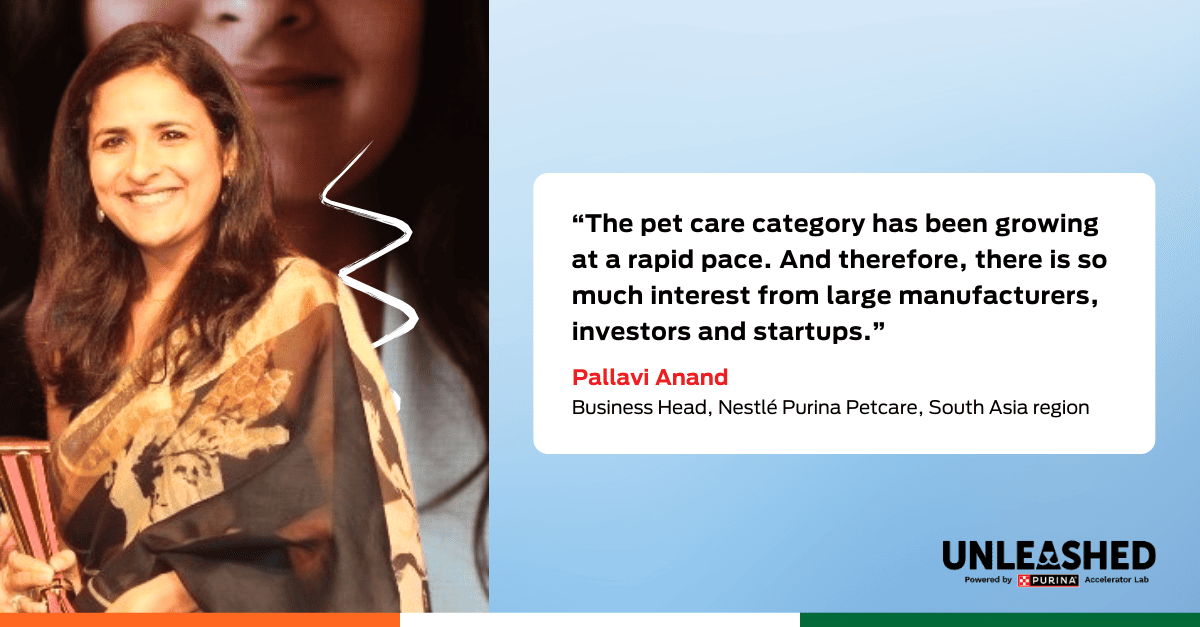

According to Redseer’s market report, spending in the Indian pet care market reached $3.6 billion in 2024 and is projected to double this figure by 2028.

With an estimated compound annual growth rate (CAGR) of 20%, experts predict that the market size will be $25 billion (INR 2.1 trillion) by 2032.

As with most pet markets, dogs dominate at 65% followed by cats at 25%.

As we break down the categories, pet food, of course, owns most of the market share, which makes sense as a basic need. But pet services and products are not too far behind.

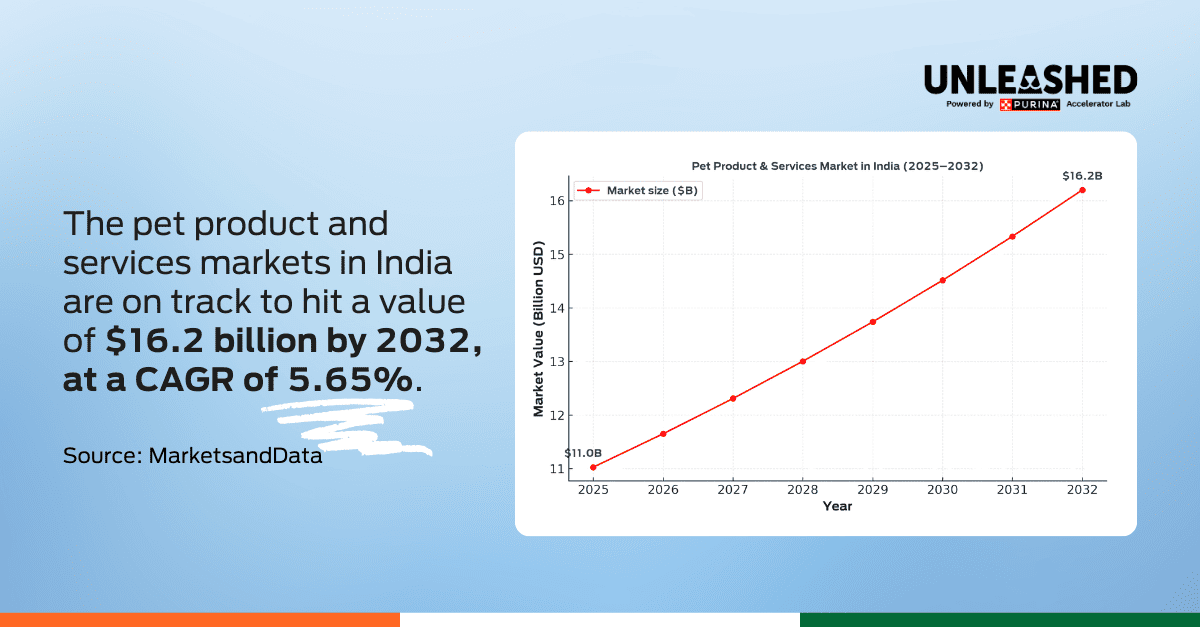

In fact, pet products and services are on track to hit a value of $16.2 billion by 2032, at a CAGR of 5.65%.

But what is driving this accelerating growth? Here are the key factors:

The rise in pet parenthood

Reports suggest that the number of pets in Indian households has risen from 26 million in 2019 to 32 million in 2024. It’s clear that the pandemic was a driving factor in that growth.

Pallavi Anand, Business Head, Nestlé Purina Petcare, South Asia region, said, “I think a pivotal change for pet ownership happened during COVID. The need for companionship emerged and has stayed consistent in India ever since”.

And the data supports the notion that pet adoption is continuing to rise post-pandemic. In 2023 alone, around 600,000 pets were newly adopted, predominantly by first-time pet parents.

However, as the title of this section suggests, not only has the number of pets and pet parents risen in India, but there has also been a shift in the culture of pet ownership seen now as ‘parenthood’.

All of the speakers I interviewed for this article mentioned the word ‘family’ when referring to pet ownership. This is a fundamental shift in attitudes which is being led by the younger generations.

Digital commerce dominates

While pet ownership grows, so too do the ways in which Indians buy premium products for their pets.

Anand, from Nestlé Purina Petcare, said, “We are seeing rapid growth in the e-commerce channel in India, especially in Quick commerce where delivery happens within 7 to 10minutes”.

Bain Consulting reports that digital commerce as a whole has reached $60 billion in gross merchandise value (GMV), making India the second-largest online shopper base in the world.

Online sales of pet products have grown 95% year on year, according to a 2025 report.

Q-commerce players, such as Blinkit, have partnered with domestic retailers, like Heads Up For Tails, to deliver to pet parents faster than ever before.

Urbanisation and generational shifts

With the number of nuclear families rising, so too does the desire for pet adoption.

We can also see clear generational shifts where millennials and Gen Z are shifting to smaller, urban households with higher disposable incomes than ever before.

This correlates with an increase in spending on pet food, supplements, grooming and vet services.

Hariharan Premkumar, Managing Director & Head of India at DSG Consumer Partners, said, “India is getting to that $3,000 per capita income mark. If you look at the trends globally, that's typically the inflexion point when pet adoption grows massively”.

That said, not all cultural shifts are as stark. For instance, feeding your dog or cat homecooked meals is still prevalent across the country.

Anand, from Nestlé Purina Petcare, said, “The calorific coverage is still at about 6 to 7% for dogs in India. So it is extremely low as of now”.

She cites affordability and knowledge of pet nutrition as the primary culprits, but there’s also a cultural piece that runs deep.

Anand continues, “Even if people can afford [to buy commercial pet food], they don’t feel the need to give their pets anything apart from homemade food. Pets are being treated as family, and giving a home-cooked meal is an expression of your love for your family”.

While pet parenthood is increasing nationwide, there is still an education gap when it comes to how to care for a pet. This is a fundamental challenge that pet care innovators must navigate if they want to penetrate the market.

Regional differences in pet care

So, we’ve covered the macro trends affecting the country as a whole.

However, as Rashi Narang, Founder of Heads Up For Tails, said, “India is so diverse in its habits and culture and spaces. So every city is almost like a mini market”.

If we consider ‘India’ as many ‘little Indias’, the portrait becomes even more nuanced.

Let’s take a look.

The major cities

The metropolitan hubs across the country have seen the most growth when it comes to accessibility and variety of pet care products and services.

Because of the higher disposable income in cities and a greater young professional crowd, the cities drive most of the growth in the pet food sector in particular.

But products and services follow suit.

In places like Delhi, Mumbai and Bengaluru, you’re far more likely to see the most premium offerings of the pet market, including grooming services and pet spas.

Heads Up For Tails has grown a substantial pet spa network with over 60 locations.

Equally, it’s in the bigger cities where you’ll find dog walking apps like Sploot and small animal veterinary services.

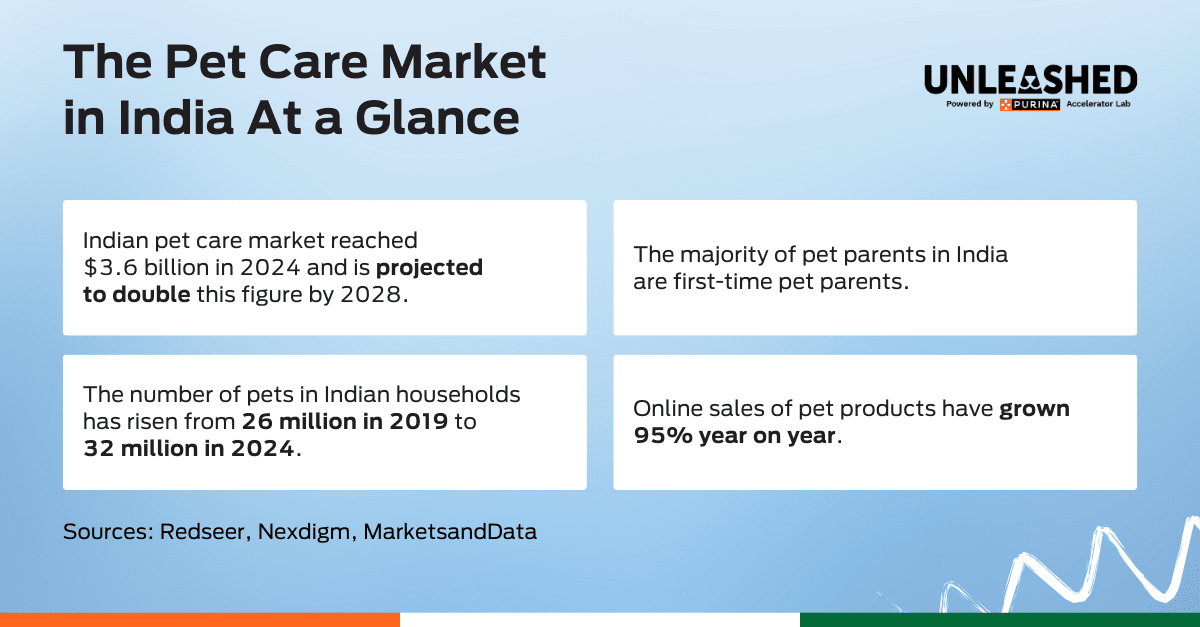

North India

North India accounted for a whopping 35% of the pet food market share in 2024. This is not only because of the larger cities like Delhi, Chandigarh and Jaipur, but also because of the pet type distribution.

Northern Indian households tend to be larger and therefore have a preference for large dog breeds.

West India

West India is the second-largest hub for pet products and services. It’s predicted to account for 33.6% of the total revenue in 2025.

The increase in nuclear families and pet-friendly housing options in Mumbai and Pune has led to significant market growth in the region.

South India

As with the other regions we’ve discussed so far, cities like Bengaluru, Chennai and Hyderabad have a steadily growing middle class and therefore more access to premium pet services and products.

Notably, cats and fish are far more popular in South India than anywhere else in the country. Though the cat population hovers between 4 and 5 million, as people move into smaller homes in urban cities, we may see a broader shift in cat ownership overall, as we’ve seen in other markets.

East India

East India accounts for the smallest market share in the Indian pet market, which is mostly concentrated in the main cities—Kolkata, Bhubaneswar and Guwahati.

That said, due to fewer distribution channels and consumer awareness, pet market growth may be a little slower in this region.

Startups making waves

The pet care startup arena in India exploded post-pandemic with INR 470 million raised in 2021 alone. In 2024, this dropped to INR 144 million, but the fact remains; the opportunities are out there. Here’s a little snapshot of the pet care innovators you need to know about in India.

Pet retail and e-commerce

Heads Up For Tails is often touted as India’s leading pet lifestyle brand. The company grew from a tiny kiosk in Select City Mall in Delhi, to over 90 stores, 68 pet spas and an expanding online presence. They secured INR 2.8 billion in their Series A round in 2021.

Founder of Heads Up For Tails, Rashi Narang, told me how the brand’s focus on understanding the market was key to their success.

She said, “We decided to go offline in a time when online was really the buzzword because we were still at a point where there was no awareness and we needed to enable a lot of discoverability. That strategy so far has really helped us”.

By comparison, Supertails is an online-first platform that has since expanded into offline retail, vet teleconsults and curated products.

When I asked about DSG Consumer Partner’s decision to invest in Supertails, its Managing Director & Head of India, Premkumar, said, “We had a very strong point of view on the pet market opportunity in India for years, even before we met Supertails. When we got introduced to the team and given their backgrounds, we knew that they had the skill set to really tackle the pet market opportunity and build a one-stop destination for everything pet”.

Vet care

Vetic, a pet clinic startup, is another one to watch in the region. Veterinary care across the country differs immensely, with the majority of vets honing their craft with large animals first, given that India is still a farming country.

That said, there has been an uptick of small animal vets, especially in the main cities.

Founded by Gaurav Ajmera, Vetic is on a mission to raise the standard of veterinary care for pets nationwide and bring a tech-forward solution to pet parents. They have over 40 healthcare centres in 11 cities so far and are expanding fast.

Pet services

Grooming, dog walking, pet hotels and so on make up a much smaller market share than vet care and pet food.

A good example is local dog walking app Sploot, which has 80,000 pet parents registered in 15 cities.

Given that even pet food can be a hard sell in India, the more niche services have quite some way to go.

However, Anand, from Nestlé Purina Petcare, South Asia region, remains optimistic.

She said, “The whole fabric, the whole emotion of the consumer towards pets is changing. If that trend continues, which it will, the entire pet ecosystem will build around it itself”.

The opportunity ahead

Just six years ago, it would’ve been much tougher to convince investors that investing in the pet care market in India was worth it.

Premkumar, from DSG Consumer Partners, said, “Pre-pandemic, there weren't many investors interested in the pet segment in India because they just felt that it was a long-term opportunity and maybe too early for them to invest in”.

But now, Indian pet care startups don’t need to justify the addressable market.

It’s clear that there’s a growing army of pet parents ready to buy.

So what should entrepreneurs be focusing on to make their mark in the Indian pet care market?

Closing the education gap

Throughout my conversations for this article, a common theme arose again and again: the challenge of consumer awareness.

Or in other words:

- Does the market understand the need for your product or service?

- Does the consumer have enough knowledge about how pets should be cared for?

- If the consumer does feel confident about caring for their pet, does your product or service actually suit their needs?

Given that pet parenting is so new in India, we know that there will be a learning curve.

Startups like Heads Up For Tails and Vetic are leading with educational content and building consumer awareness, which also builds trust with the consumer.

Tech-enabled vet/pet services

Pure pet tech enterprises are few and far between in India at the moment, with most homegrown brands focusing on a combination of in-person and digital bases.

However, the millennial and Gen Z generations are very much digital first. Convenience will also become more important as incomes rise.

Creating tech-first apps for common pet parent gripes, such as finding a pet sitter or even locating lost pets, have a great opportunity to thrive in this nascent market.

As we’ve discussed, veterinary services and teleconsults have a huge market opportunity here too.

Premkumar, from DSG Consumer Partners, said, “Beyond pet food, the most investments currently are happening in vet clinics and services. It's a massive opportunity”.

Differentiation and personalisation

Given that the majority of pet parents in India are first-time pet parents, it’s fair to assume they haven’t figured it all out yet. Relatable! Even if you’ve grown up with animals , your consumer preferences change as you learn more about your pet and your unique way of caring for them.

So, while standardised products and offerings are more common with the nascent pet market, pet parents will understand their preferences and needs far more in the coming years.

This is where more differentiated products could see more growth, especially when it comes to regional and cultural differences across the sub-continent.

E-commerce/omnichannel retail

Digital commerce is already huge in India. But if the distribution channels were more developed across the country, we could see the pet care industry skyrocket beyond recognition.

However, this is only a viable avenue if innovation is at the forefront. With already established brands dominating the market, it will take an alternative approach and more focused customer base to penetrate. After all, the market is booming, but still comparatively small when compared to other markets. So differentiation in the space is key.

A slow climb to the top?

As we’ve seen, the Indian pet care market is in its infancy but has immense potential.

Hubert Wieser, CEO of Nestlé Purina PetCare AOA said it best when he said, “India is probably the last ‘mega’ market in the making”.

Given the sheer population of pets and the changing attitudes towards them, it’s inevitable that India’s pet care market will reach the size of the US or EU. It’s just a matter of when.

And however things unfold, Unleashed by Purina will be there, ready to support, nurture and uplift Indian pet care innovators to usher in the next phase.

Written by Olivia de Santos, Pet Tech Writer @ Unleashed by Purina.