The pet food supply chain is the backbone of the industry, connecting ingredient sourcing, production, packaging, and distribution to ensure pet food reaches homes around the world.

That said, the 2020 pandemic was a turning point, which led to innovation and failsafes to keep the pet food market moving. Add to that the pressure of the pet adoption boom, and you have an operation that needed to optimise in the most challenging circumstances in our modern day.

Fast forward five years. What does the pet food supply chain look like now? Has e-commerce continued to dominate? And where could we see even more innovation to improve the pet food supply chain five to ten years from now?

With insights from Davide Mussutto, VP of Global Operations at Nestlé Purina, this article explores the key developments and future opportunities shaping the global pet food supply chain.

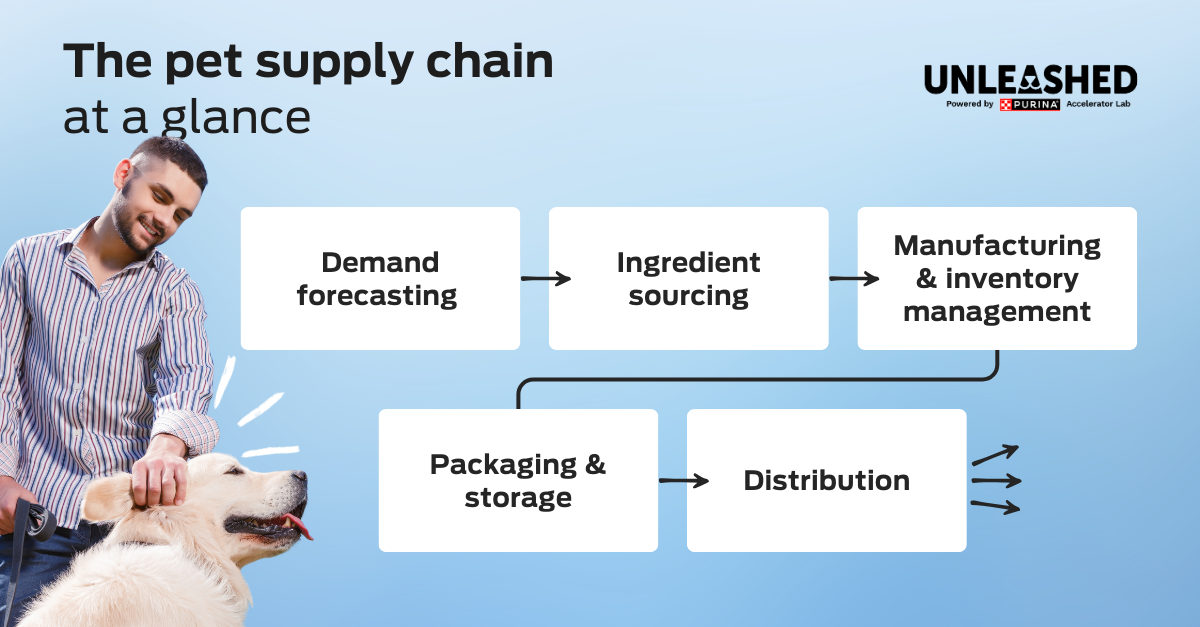

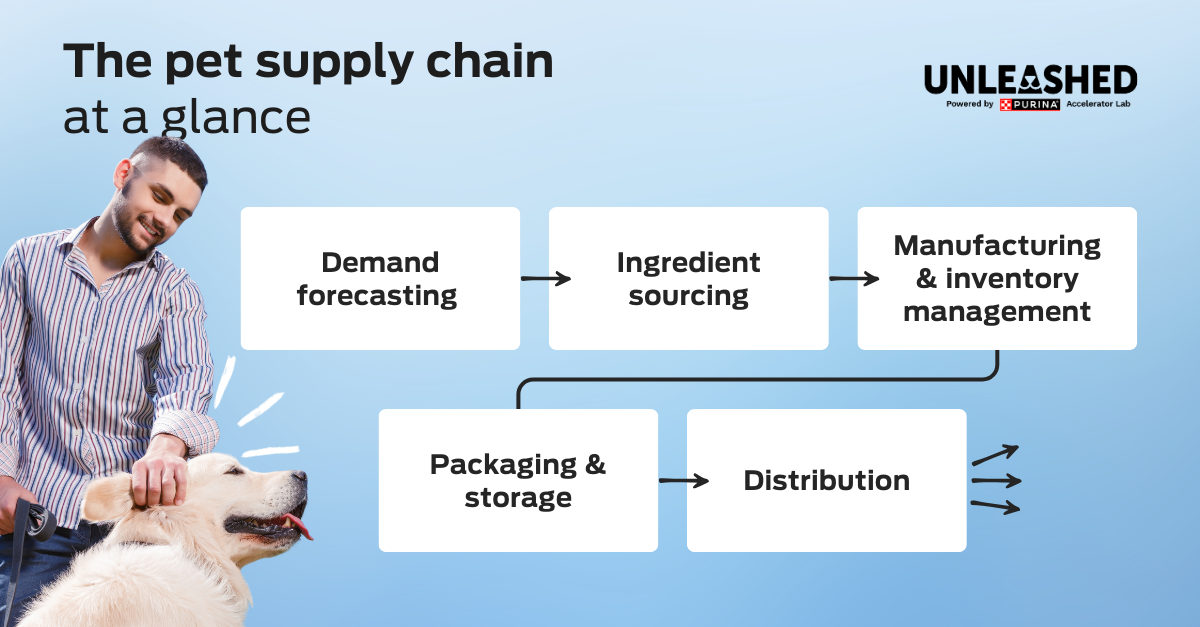

The pet food supply chain decoded

Given that the pet food supply chain often operates behind the scenes, it can be easy to overlook how it underpins everything from ingredient sourcing to product delivery across the pet industry.

We can distil it into five key parts:

Demand forecasting

Most supply chain graphs would claim that ingredient sourcing is the first pillar. It’s the age-old question of supply vs demand. But my discussion with Mussutto revealed that accurate demand forecasting is key to a well-functioning pet food supply chain.

“We need to have good alignment between the sales team, the planning team and the manufacturing team. Because if the demand is not accurate, the factories can’t produce what is required by our customers and ultimately pet owners” he said,

Demand forecasting is typically done with a combination of historical data and econometric models. But put a pin in this, as we’ll return to forecasting as a key opportunity for innovation later.

Ingredient sourcing

Next is the sourcing of raw materials. In the United States alone, a 2024 report showed that approximately 9.8 million tons of pet food containing more than 600 plant- and animal-based ingredients were produced and sold that year.

On a global level, the pet food ingredient market is projected to reach $47.4 billion by 2028, driven by growing demand for diverse and high-quality protein sources. Chicken and chicken-based products remain among the most common base ingredients used by weight, with regional variations depending on local supply and consumer preferences.

Manufacturing

The manufacturing process could be an article in itself. For our purposes, what matters most is maintaining product quality and ingredient integrity as raw materials move through production.

Once ingredients reach the factory, supply chain teams work to maintain optimal inventory levels—enough to meet demand, while avoiding excess that could lead to waste. Achieving that balance requires precise coordination across planning, production, and logistics teams.

Packaging

At the packaging stage, packaging materials need to be fit for distribution purposes and readily available so that pet food can flow out of the factory smoothly. The size and weight of the packages are all part of the efficiency and optimisation of supply chain professionals.

Distribution

Finally, the product can leave the warehouse and reach the retail store, e-commerce warehouse or pet owner’s home, depending on the point of sale. Sustainability in delivery and logistics is key here.

Now you’re all caught up, let’s talk about the challenges facing the global pet food supply chain today.

The main challenges facing the pet food supply chain today

It’s incredible how large scale global operations like Nestlé Purina’s operate. We’re talking millions of tons of pet food sourced, manufactured, packaged and sold throughout the world.

However, there are two main challenges facing the pet food supply chain today:

Sustainability throughout the chain

Sustainability is a multi-pronged issue. For the supply chain, being sustainable means:

- Sourcing ingredients responsibly from ethical and sustainable suppliers.

- Identifying and securing fit-for-purpose recyclable packaging materials, a challenge highlighted by Mussutto

- Reducing the carbon footprint of logistics operations.

- Refining demand forecasting to minimise waste.

To ensure Nestlé Purina meets its target of achieving Net Zero by 2050, Mussutto emphasised that local ingredient sourcing is a key pillar of the company’s approach.

He explained, “The global strategy is to produce where we sell. That way, we’re reducing transport time, which is much better for the environment.”

International regulations

Another key challenge for the pet supply chain is international exports and imports. We all know what can happen when this stalls on a global scale, as seen during the pandemic. Even under normal circumstances, moving products between countries can be complex when they’re manufactured across different regions of the world.

Local sourcing and manufacturing therefore present many advantages.

However, that doesn’t mean that the pet food supply chain won’t brush up against regulatory changes on a local stage. The EU’s Packaging and Packaging Waste Regulation (PPWR) and the Single-Use Plastics Directive (SUPD) are good examples. Therefore, supply chain professionals and innovators continually adapt to geopolitics and regulatory amendments.

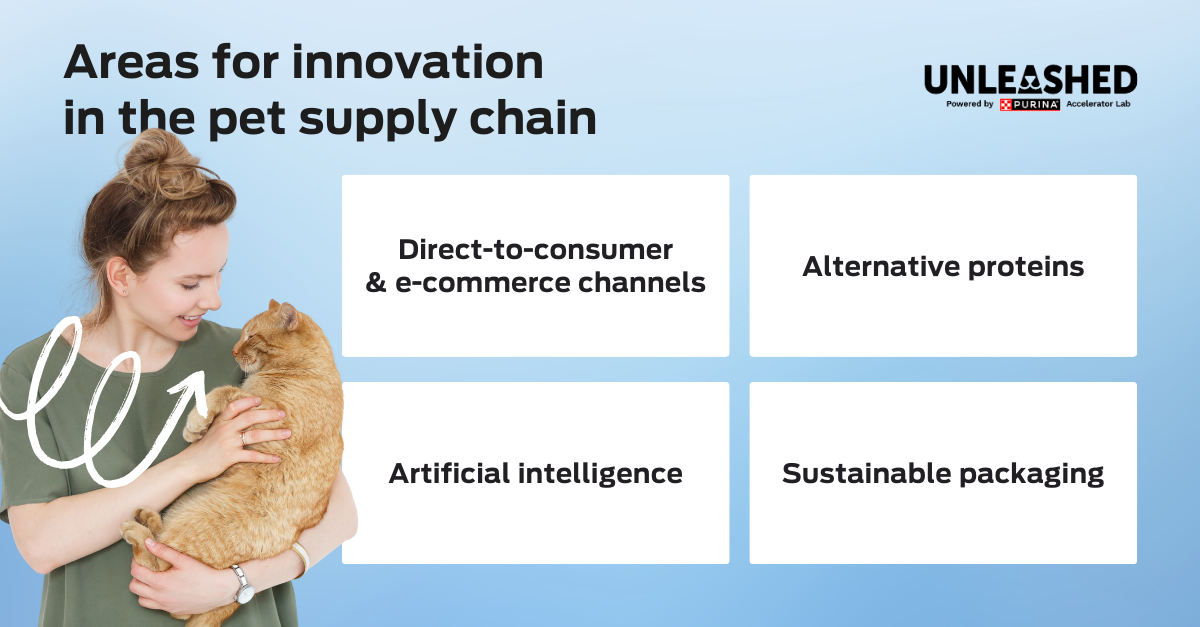

Areas for innovation in the pet food supply chain

In many ways, the pet food supply chain is a well-oiled machine, especially when we consider the scale and size of international logistics operations like Nestlé Purina’s.

While technologies such as delivery drones, driverless vehicles, and quick commerce models are advancing rapidly, innovation in logistics is now focused more on incremental improvements in efficiency, traceability, and sustainability rather than disruptive change.

That said, there are plenty of opportunities for innovation within the pet supply chain.

Direct-to-consumer (DTC)

The global pet care e-commerce market was valued at approximately $94.89 billion in 2024, with food and treats accounting for around 34.6% of this total, equivalent to roughly $35 billion in global online sales. This is expected to rise in the coming years, due to increasing pet adoption and digital native Gen Z becoming pet parents.

Mussutto mentioned that many pet parents in China predominantly use e-commerce and DTC channels to purchase food and products for their pets.

In the US, online sales of pet food grew from 13.3% in 2016 to 36% in 2022. While some forecasts suggest that e-commerce could reach 50% of pet food sales in the US market, in-person shopping through supermarkets and specialty stores continues to dominate overall sales.

I asked Davide Mussutto for his take on whether DTC may take over in the future.

“Overall, as a company, we are working on all channels. That includes e-commerce and direct to customers. But this is really a customised strategy, depending on the country and the region. Our responsibility is to provide our consumers—pet owners— the possibility to access our products where they want”.

Alternative proteins

Another key driver of innovation in the pet supply chain are the raw materials themselves.

As more pet owners seek specialised formulations, such as grain-free or single-protein recipes in treats,sustainability and responsible sourcing are increasingly influencing purchasing decisions.

Unleashed by Purina has accelerated a couple of startups proposing new sources for pet food, including Umami Bioworks who create pet food from cultivated seafood, and Arbiom, which produces SylPro, a fermented single-cell protein derived from sustainable sugars and agricultural by-products.

However, there are a few hiccups when it comes to wide scale adoption of these alternative raw materials.

The first is regulation. Because these alternative proteins are so new, navigating compliance and safety assessments can take several years. That said, Umami Bioworks had a huge breakthrough in 2025 to pilot a cultivated protein-based product in the EU, UK and Singapore, which is expected to hit shelves in 2026.

The second piece is more complex: consumer acceptance. Though lab-grown meats and alternative proteins may be nutritionally complete for pets, consumer culture is difficult to shift. We’ve seen this play out in the human food world, as plant-based food companies have seen falling sales due to perceptions around processing and economic uncertainty.

Backing from large pet food manufacturers, like Nestlé Purina, could be a gamechanger, meaning more sustainable raw material sources in the future.

Mussutto told me, “As other manufacturers, we are invested in everything that is more sustainable. Plant proteins and alternative raw materials are interesting in this aspect”.

That said, it’s too soon to say what percentage of the market alternative proteins may take in the future.

AI & Demand Planning

The AI buzz is far beyond a trend. It’s fair to say it’ll permanently transform the way multiple industries operate. The pet food supply chain is no different.

“We see artificial intelligence as an opportunity to help us to better define the demand forecast. That will help us optimise production planning to provide even a better service for our clients”, said Mussutto.

Think automated raw material orders. More accurate consumption reports. Less waste and greater efficiency overall. Out of all of the innovations, AI seems to be one of the key components that could accelerate growth within the sector.

Packaging

Finally, more sustainable packaging and formats are high on the agenda for pet food supply chain professionals.

Mussutto told me, “We are pioneers in D4R (design for recyclable) packaging. We are always improving our packaging to provide even a better experience for our clients”.

One of the challenges with packaging is the increase of e-commerce and DTC formats. The size and formats of bags differ from that of traditional distribution channels. So the supply chain welcomes innovation in recyclable packaging, not just for the sake of the planet but also to improve the shopping experience.

Mussutto said, “I think the packaging can always improve the shopping experience, not only the use of the product, but how we select the product, how it feels to use it, and so on”.

What the future holds

When we talk about innovation in the pet industry, most jump to pet service apps, biometric readers and health trackers. The pet food supply chain may seem less glamorous by comparison, but it remains the foundation that keeps the entire pet ecosystem running.

Because of its efficiency, scale, and well-established methods, innovation may seem subtle. An AI model here. A new packaging initiative there. Yet, as these advances take hold across the pet industry, they can drive meaningful progress toward greater efficiency and sustainability overall.

In other words, innovation within the pet food supply chain equals innovation throughout the pet world.

We at Unleashed by Purina are excited to see the innovators who can pioneer a sustainable future for all pet parents around the world.

Written by Olivia de Santos, Pet Tech Writer @ Unleashed by Purina.